Articles of Incorporation are filed with the state to form a corporation. While Articles of Incorporation can be long and drawn out, they don’t have to be. Most states have a few basic requirements for essential information (like your corporation’s name and how many shares you want to authorize) that can be addressed quickly and simply. We offer a free Articles of Incorporation template you can use to form your new corporation.

Articles of Incorporation are filed with the governing agency in your state in order to register your corporation. Feel free to use our Articles of Incorporation template, but please do not take this form as a replacement for competent legal counsel on your specific needs. Like all our forms, our Articles of Incorporation template is intended for individual use.

If you would like our help forming your corporation, we incorporate businesses every day. We’ll get your corporation set up correctly the first time for only $100 plus state fees. We also provide industry-leading registered agent service for $125 a year.

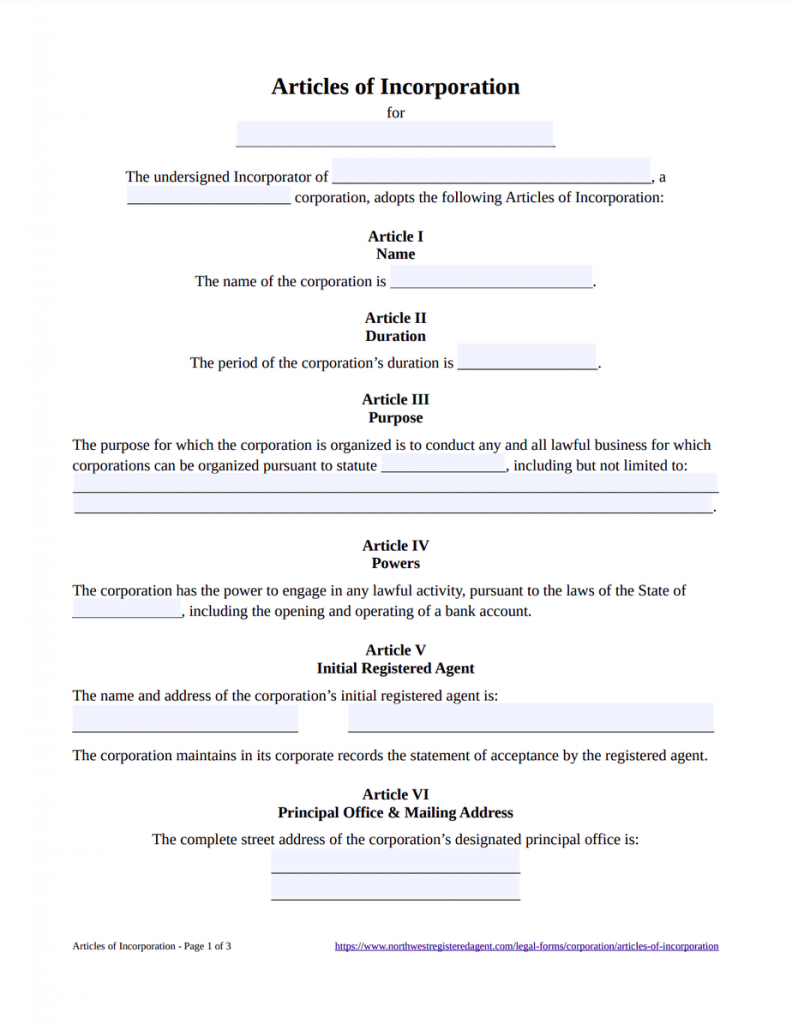

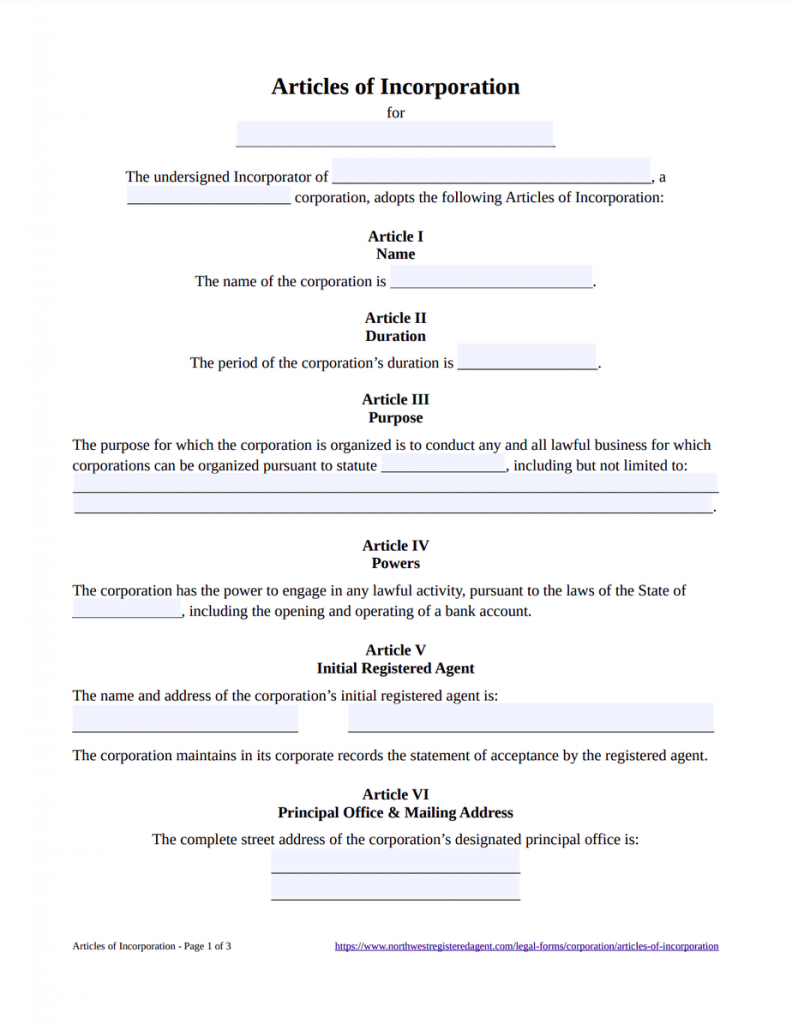

Our Articles of Incorporation are straightforward and brief, addressing common state requirements. We don’t waste space regurgitating all the laws of a state. The laws are the laws, no matter what you write in your articles. The state clerk certainly doesn’t want to have to dig through 15 pages of text just to find the 3 or 4 items you actually need to incorporate. Really, the state just wants enough information so they can process your form and keep tabs on your business (and make sure you keep up with any taxes and annual report fees).

So, we’ve drafted an Articles of Incorporation template that lists the information the state really wants to see in a couple of pages. Our form is easy to complete, easy to understand, and easy for state agencies to process.

Now, if you have complicated legal needs, consult an attorney and pay for an attorney-drafted Articles of of Incorporation. Otherwise, for the everyday business, basic Articles of Incorporation are just fine.

While exact requirements differ from state to state, you’ll generally need your corporation’s name, registered agent, principal address, share information, director information and incorporator signature. Our comprehensive Articles of Incorporation template covers these topics and more:

Your corporation’s name typically needs to include a corporate identifier, such as “Corp.,” “Inc.,” “Corporation” or “Incorporated.” To ensure the name you want isn’t already taken in your state, you can do a business name search to check for availability.

Duration is how long your business will exist. Most corporations are perpetual, meaning they continue until they are dissolved.

Your purpose is the primary business activity your corporation plans to engage in. In some states, it’s enough to list a general purpose (“to conduct any and all lawful business”), but other states require you to list a specific business activity, such as “real estate management.”

This section explicitly gives the corporation powers to act under the state’s corporation code, including the power to open a bank account. While this statement isn’t actually necessary (state laws already give your corporation these powers), including this statement can make things easier when you go to open a corporate bank account.

You’ll need to list your registered agent and registered office. Your registered agent accepts legal notifications on behalf of your corporation. Your registered office is the street address in your state where the agent is available during regular business hours. Prefer not to hang around the office all day or list your personal info here? Many businesses opt to hire a registered agent service like Northwest.

Some states require registered agents to acknowledge their appointment with a signed statement. This way, no one is appointed without their knowledge. The statement also assures the state that someone is actively taking responsibility for the registered agent role.

Your principal office is your official business address. A street address is typically required. You can add a mailing address as well, which can be a PO Box.

You’ll need to decide how many shares of stock you’d like to authorize (create). States typically require you to authorize at least one share. You’ll also need to note any classes of shares (such as common and preferred). Some states also require par value, so there’s a place to add this information here as well.

What’s par value? Par value is the “face value” of the share and typically the lowest price at which a share can be sold. Some states require par value (like Rhode Island) while other states allow for “no par value” shares (like New York and Delaware). Note that par value can affect filing fees in some states. For instance, in Missouri, your filing fee increases if you have more than $30K in combined par value.

List your corporation’s directors and officers, including their titles and addresses.

This section notes that the corporation will adopt initial bylaws. Need a template for bylaws? Check out our free corporate bylaws template.

This article focuses on how distributions will be handled if the company dissolves, noting that distribution procedures will be included in the bylaws and will follow applicable state laws.

Essentially, this section notes that those acting in good faith to benefit the corporation are indemnified (protected from liability).

Your incorporator signs and submits the Articles of Incorporation. The incorporator can be a director or officer, or someone else you authorize to complete this paperwork. If you hire Northwest to form your corporation, we’ll be your incorporator.

Your Articles of Incorporation form and fee are filed with an agency in your state—typically the state’s Secretary of State office. Once filed, some states send you a Certificate of Incorporation while others just return your Articles of Incorporation with an approval stamp.

Once your Articles of Incorporation have been approved, your corporation is legally registered—but that doesn’t mean it’s necessarily ready to do business. For instance, you’ll want to open a bank account, get an EIN, and obtain any required business licenses or permits.

No, procedures and requirements for forming a corporation are decided state by state. So, filing fees and exact requirements vary. To ensure you provide all the necessary information, many states have their own Articles of Incorporation form you can download from the state agency’s website.

You can also find these forms and other state-specific filing requirements (like filing fees) on our individual state corporation pages. Just select your state from the drop down on our “Incorporation Guide” page. Our Articles of Incorporation template, however, will meet the general requirements of most states. We also offer a few state-specific forms below: